top of page

Capital Advisors

RURAL TELCO INSIGHTS for Private Equity

Find the AI-based opportunities for EBTIDA growth in rural telecommunications here!

Blog and Resources

Search

What Logistics Stock Performance Reveal About the Real Economy in 2025 and the outlook towards 2026

If you want to understand the U.S. economy, don’t start with GDP or the jobs report. Start with the companies that actually move goods—parcel carriers, trucking fleets, freight brokers, and global shipping lines. They are the circulatory system of the economy. When they slow, it’s a leading indicator. When they surge, it’s usually real. ShadowHornet Capital Advisors took a look across 20+ major logistics and shipping companies shows a striking message: the U.S. goods economy

Private Equity’s Great Reset: What 2025’s Market Signals Tell Us About 2026

The world’s largest private-markets managers—Blackstone, KKR, Apollo, Carlyle, Ares, Brookfield, StepStone, Blue Owl, 3i, EQT, and others—are quietly sending a remarkably clear message about where the global economy is heading. And if you read their stock performance closely, you can extract a sharp picture of both current conditions and the near-future outlook heading into 2026. The short version? Private equity is renormalizing. But that renormalization is exposing the bigg

For the Past 2 Years, Public Markets Have Raged Against IT Services. What Are They Telling Us?

Over the past two years, public markets have delivered a brutal verdict on traditional IT services, BPO, and staffing firms. A performance matrix of 20+ listed companies across IT professional services, large- and mid-cap IT, BPO, and staffing/HR shows deep, broad-based drawdowns, frequently in the 50–80% range over two years, with only a handful of notable exceptions. This isn’t a routine correction. It looks like a structural repricing of an entire business model. Below is

South Carolina, North Carolina, southern Virginia | LMM Private Equity and Family Offices Structure

ShadowHornet helps lower mid market private equity firms and family offices in the southeast U.S. (North Carolina, South Carolina, and southern Virginia) recover EBITDA without destabilizing your business in 1-2 quarters. Market Segmentation Report | Private Equity and Family Offices (LMM Only) : South Carolina, North Carolina, Virginia (Hampton Roads region + Roanoke (only)) 68 Private Equity firms and Private Offices in North Carolina, South Carolina, and southern Virgini

The 401(k) Executive Order: A Seismic Shift in Retirement Capital Flows (And a Timely Exit for Alternatives)

On August 7–8, 2025, President Trump signed a sweeping executive order that opens the gates for private equity, real estate,...

Part I. Rural Telecommunication Providers: The Opportunity Surface Area for AI Solutions

Telecommunications is an asset and operationally heavy business. Its core technology deployed resides over wide swaths of earth and...

AI financial analysis will never replace financial equity analysts, right? Or has it already?

Equity analysis, once the exclusive domain of high-credentialed and highly educated analysts is being performed at scale entirely via AI. In fact, ResearchHornet.com attained a milestone on May 1, 2025, in which its entire analysis workflow was automated end-to-end, with the outputs automated into a podcast.

Resources for Family Businesses to Help Evaluate Capital and Strategic Finance Solutions

What are the Most Common Issues That Family Businesses Face in Making Strategic Finance Decisions? The US SBA indicates that 77% of...

The Best Resources for Family Businesses as they Consider Financing, Growth, or M&A Solutions

You can find resources to help family businesses online, but what are the best sources - the most effective and not the most flashy....

CIM Template to Help You in Your Fundraising and/or Exit Journey

Download our CIM template by clicking the image above or the link below Get the free template for download here: Confidential Information...

2025 Is a Favorable time to Consider Selling a Business, as Buyers and Sellers both find factors working in their favor

The M&A outlook for 2025 has taken a decided uptick since November's election, as key policy and regulatory risks have dissipated. Gone...

What is a Digital Twin and why does it matter to the Energy, Electric Power, and Telecom Industries? (Part 1)

Digital twins have revolutionized automotive and component manufacturing for nearly a decade. But their application has been limited in...

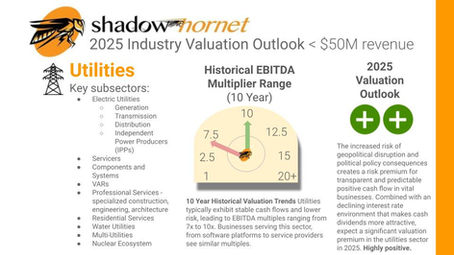

The CAGR potential of the electric power market is downright "shocking" (Part 2)

Our second post illustrates the TAM / CAGR of the electric power market, the market segments of the electric power and grid modernization...

The CAGR Potential of Electric Grid Modernization is downright "shocking" (part 1)

An Investor's Guide to Companies and Opportunities in the Electrification/ Power / Grid Modernization sector This guide provides an...

Global ignorance is really biting "U.S." in the a**

While American managers argue about whether nearshore countries can effectively take on tier 1 technical support, your competition has...

AI will disrupt, dislocate, and destroy, and ironically give you the opportunity of a lifetime...

While AI is already taking a toll on recent technology hiring, current employees, and industries (like ed tech), it's also creating...

How ShadowHornet is helping to disrupt the 40 hour work week with the Trusted Talent SmartCloud...

See our founder, Thomas Mirc, discuss the current market trends and impact of AI that's giving you the opportunity of a lifetime to...

Transitioning from Founder-led Sales to a Professional Sales Engine: Navigate Around Common Pitfalls

Small and mid-sized businesses are getting hit particularly hard in the new economy. One area of consistent struggle for businesses is...

Is your business prepared for a long economic winter? 5 steps to take now to thrive in the downturn

Whether you’ve weathered the economic downturns of 2001, 2008, or 2020, this time it’s different. Here's what software product and...

Corporate Arrogance and its Ironic Impact on the Business

You’re in year 4 of a board of directors seat, and have the two below businesses in your portfolio. As a business leader or board-level...

bottom of page